From illegal outposts to academic research, from legal aid for Jewish terrorists to yeshivas, the tens of millions of dollars that U.S. non-profits send each year to the settlements support all sorts of activities in Jewish enclaves across the West Bank.

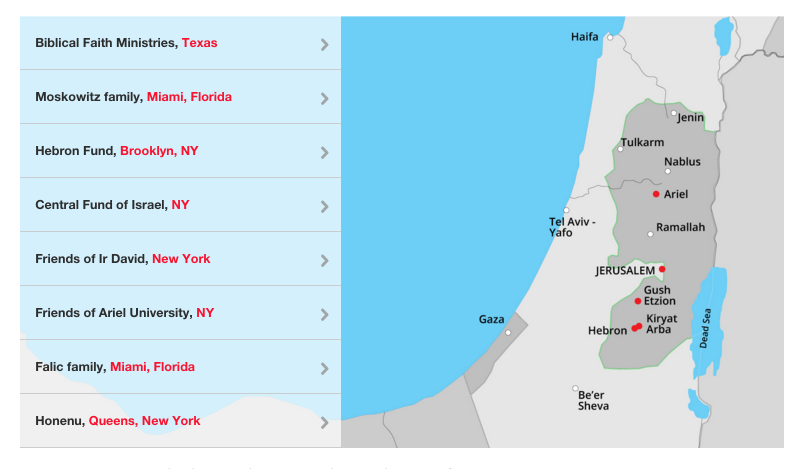

As part of the Haaretz investigation into the flow of tax-exempt dollars to the settlements, here is a map showing some of the key donors and their main beneficiaries.

The months-long investigation by Haaretz correspondent Uri Blau focused on some 50 U.S.-based organizations that funnel money to the settlements or to Israeli non-profits that support them.

The American charities, known as 501(c)(3) organizations under the Internal Revenue Code, are granted tax-exempt status by U.S. authorities and donors to them can claim a tax deduction on their gift.

Between 2009 and 2013, the last year for which there is extensive data, these organizations reported combined revenues of more than $281 million (over one billion shekels). Most of these funds came from donations, while some came from returns on capital investments.

Some $224 million of this income was transferred to the occupied territories as grants, mostly through Israeli non-profit groups.